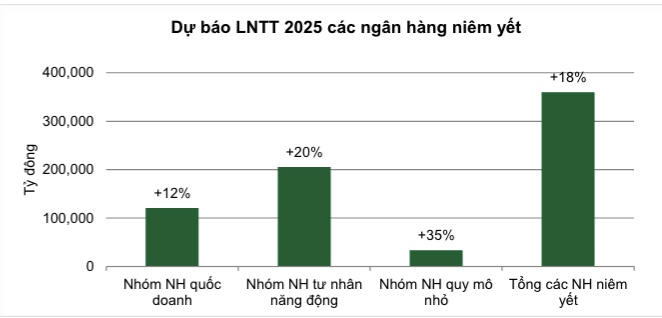

According to VCBS, the dynamic private banking group is forecast to grow pre-tax profits by 20%, while the state-owned group will increase by about 12%.

In its recently released 2025 Second Half Outlook report, Vietcombank Securities JSC (VCBS) forecasts that pre-tax profit growth for the entire banking industry in 2025 could reach 18% compared to the level achieved in 2024.

Of which, the small-scale banking group is expected to have the strongest growth rate (up 35%) thanks to boosting real estate credit production from a low base level and starting to accelerate the handling of bad debts, it is expected to have notable floor transfer deals.

The dynamic private banking group is forecast to grow pre-tax profit by 20%, while the state-owned group will increase by about 12%. VCBS believes that dynamic private banks will benefit from policies to encourage the private economy and improve asset quality. This group also witnessed many outstanding stories such as IPO, restructuring, debt collection.

Specifically, VCBS maintains an optimistic view on credit growth with the forecast that the whole industry can complete the 16% growth target by the end of the year. The main driving force comes from low interest rates, many incentive packages launched for the fields of technology, real estate (RE), small and medium enterprises (SME),…

The promotion of public investment and the removal of real estate legal issues are also expected to create credit growth in the home loan and construction material segments. At the same time, the positive results of tariff negotiations between Vietnam and the US are also expected to boost production and import-export growth again.

In addition, VCBS expects the net interest margin (NIM) of the banking industry to bottom out in the second quarter and gradually recover in the second half of the year, but the recovery level is unlikely to be equivalent to the second half of last year.

VCBS believes that monetary policy continues to loosen and system liquidity is abundant. At the same time, credit demand recovers, especially from the small and medium-sized enterprise (SME) and retail segments, helping to reduce competitive pressure among banks.

Regarding asset quality, VCBS forecasts a gradual decrease in the bad debt ratio and more favorable bad debt collection activities. According to VCBS, the potential bad debt ratio has gradually decreased for four consecutive quarters, helping banks reduce pressure on debt group transfer. In particular, the legalization of Resolution 42 on bad debt settlement along with the recovery of the real estate market has made the process of recovering collateral more favorable, especially for small banks with high bad debt and receivables ratios.

Business prospects of some banks in 2025

VCBS analysts have forecast the business results of some banks in the monitoring portfolio with profit growth in 2025 forecasted from 8% to 23%.

Military Commercial Joint Stock Bank (MB) is forecast by VCBS to be the bank with the highest credit growth in the industry, estimated at 28% in 2025 thanks to the push from both wholesale and retail credit.

MB’s NIM is expected to recover in the second half of 2025 thanks to an increase in the CASA ratio (currently at the industry’s highest level of 35%) and a push to increase the proportion of retail loans. VCBS also forecasts improved asset quality of MB and positive service fee income.

With the above comments, VCBS forecasts total operating income (TOI) to reach VND 70,448 billion, pre-tax profit is expected to be at VND 35,496 billion; increased by 27% and 23% respectively.

Vietnam Technological and Commercial Joint Stock Bank (Techcombank) is expected by VCBS to have good credit growth from the recovery of the real estate and construction markets.

Similar to MB, Techcombank’s CASA ratio is forecast to continue to remain high, creating an advantage in capital costs for the bank, reducing pressure on NIM narrowing – Diversifying non-interest income helps increase contribution to profit growth profit.

In addition, the plan to IPO the subsidiary TCBS is expected to help Techcombank increase capital, revalue investments and strengthen its position in the financial market.

VCBS estimates that Techcombank’s total operating income in 2025 will reach VND55,251 billion, up 18% over the previous year; pre-tax profit will be VND33,123 billion, up 20%.

Vietnam Maritime Commercial Joint Stock Bank (MSB) is forecast to achieve a credit growth rate of 21.2% for 2025 thanks to good credit demand. At the same time, NIM will start to improve from the second half of 2025.

Asset quality is expected to improve with the NPL ratio continuing to decrease to 2% thanks to strong credit growth and increased recovery of written-off debt.

VCBS also has high expectations for completing the ecosystem with plans to divest and contribute capital to MSB’s subsidiaries: transferring part or all of the contributed capital at TNEX Finance and contributing capital to buy securities companies and fund management companies.

Based on the above assessment, VCBS forecasts MSB’s total operating income (TOI) to reach VND 16,006 billion, pre-tax profit is expected to be VND 8,029 billion; increase by 13% and 16% respectively compared to the end of 2024.

Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank) is expected to have credit growth equivalent to the industry average (16.9%) in 2025 and improve NIM from the second half of 2025 with momentum coming from both mobilization and lending.

VCBS expects VietinBank’s asset quality to be well controlled, some restructured customers who have completed the probationary period will be transferred to debt group is lower and will be reversed in the second quarter.

The analysis team forecasts VietinBank’s pre-tax profit of VND36,982 billion in 2025, up 16%.

With the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV), the analysis team forecasts total operating income in 2025 to increase by 18%; pre-tax profit to increase by 15% compared to 2024.

The basis for achieving the above results is thanks to maintaining a credit growth rate of 16% and a slight decrease in NIM to 2.3%. Asset quality is among the best in the industry with low provisioning pressure.

According to VCBS, BIDV will increase its charter capital by VND 21,656 billion to nearly VND 91,870 billion through increasing capital from the reserve fund to supplement charter capital by 7.1%, paying dividends at a rate of 19.9% and issuing private shares at a rate of 3.84%.

With Asia Commercial Joint Stock Bank (ACB), VCBS forecasts total operating income to reach VND35,242 billion in 2025 (up 5%) and estimated profit to reach VND22,672 billion (up 8%) for the whole year of 2025.

According to VCBS, ACB’s credit will continue to grow positively in 2025, driven by a clear recovery of individual customers while credit demand for corporate customers will maintain a positive growth rate thanks to the economy’s expectation of more favorable developments.

Efficiency high profitability thanks to good cost control and asset quality. Meanwhile, NIM is expected to recover slightly from the second half of 2025 thanks to improved funding costs and a slowing down of lending rate decline.

Quang Hung

Monetary security